If You Stay Organized You Dont Have To Get Organized

The best way to prepare for quarterly taxes is to keep track of all your business mileage and expenses with well-kept records. Then, the more deductions you have, the lower your taxable income will be, and the less youâll owe to the IRS. Everlance is the #1 app for tracking mileage & expenses.

With Everlance, you can automatically capture your car mileage and business expensesâwhich likely equal thousands of dollars of deductions. When preparing for taxes, download your mileage and expense records. Then, hand them over to your accountant or import them directly into your tax preparation software. Money saved! ð

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

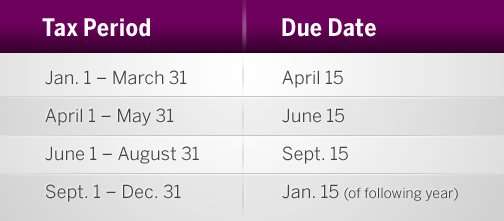

When Are Quarterly Estimated Tax Payments Due

Payments for the January 1 to March 31 period are due April 15 ; for April 1 to May 31, payments are due June 15; for June 1 to August 31, payments are due September 15; and for September 1 to December 31, payments are due January 15 of the following calendar year.

When these dates fall on a holiday or a weekend, the due date moves to the next business day. Here are the due dates for tax years 2017 through 2019.

Also Check: Did The Tax Deadline Get Extended

Small Businesses And Self

The information on this page is for:

- sole proprietorships

- self-employed individuals, including those earning income from commissions

If you are incorporated, this information does not apply to you. Instead, go to Corporations.

If you are starting a small business, see the Checklist for small businesses. The checklist provides important tax information.

Business income includes money you earn from a:

- profession

- trade

- manufacture or

- undertaking of any kind, an adventure or concern in the nature of trade, or any other activity you carry on for profit and there is evidence to support that intention.

For example, income from a service business is business income. Business income does not include employment income, such as wages or salaries received from an employer.

You Are Exempt From Paying Quarterly Taxes If:

*Note: To have no tax liability would mean your âtotal taxâ was $0 or you didnât have to file an income tax return. This is rare unless you are a low-income individual or household. Along with this, you must have been a US citizen for the whole year and your last year’s taxes must have been a 12-month period.

You May Like: Where Can I Find My Tax Return From Last Year

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

How Much Are My Estimated Quarterly Tax Payments

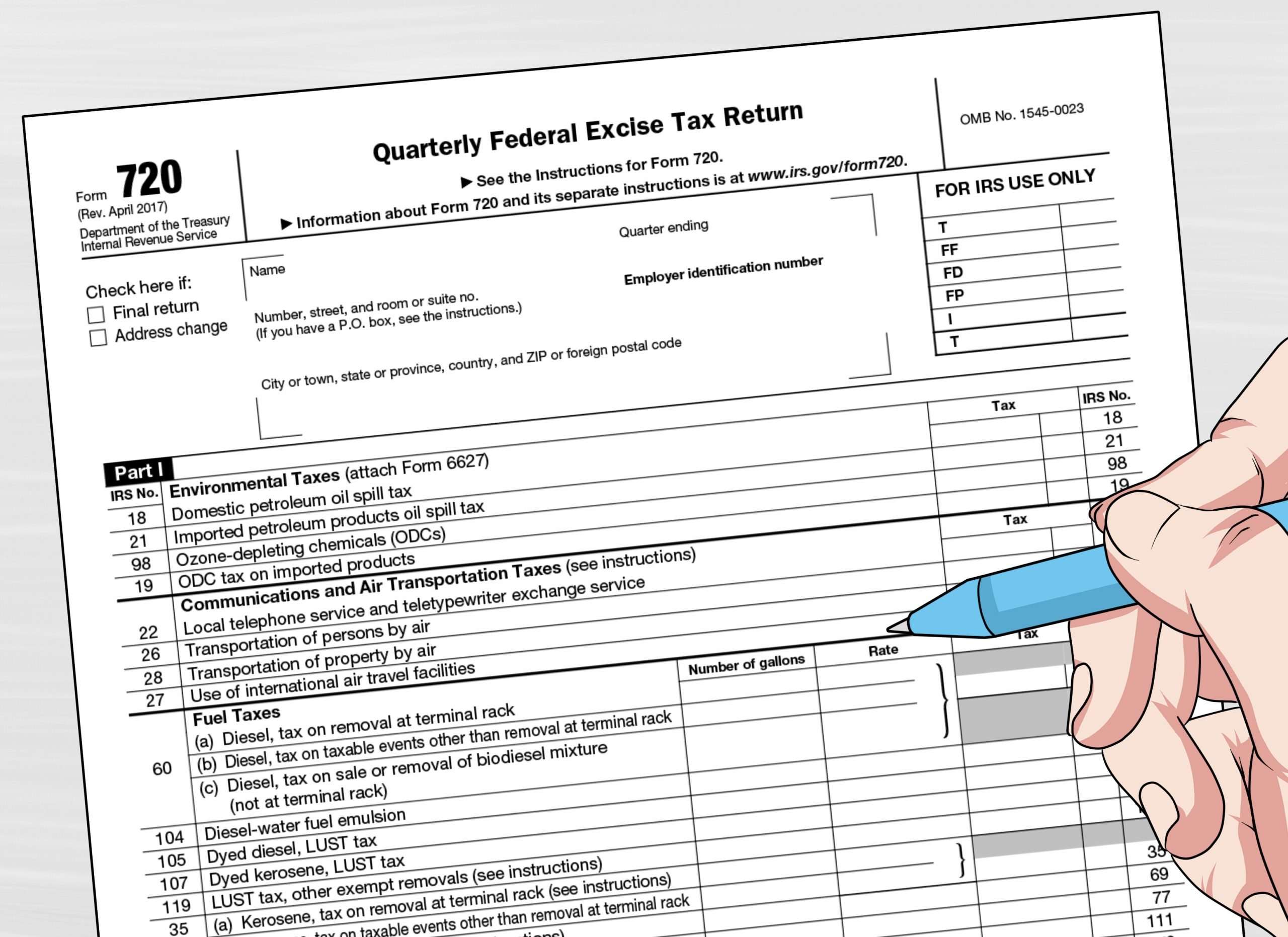

To figure out your estimated quarterly tax payments, use Form 1040 ES or Form 1120-W .

Form 1040ES requests your expected income for the upcoming tax year, and it helps you figure out your Social Security contributions and Medicare payments. Then, the form guides you through a number of calculations related to deductions and credits.

These steps generate your estimated income tax for the year. Finally, you multiply that amount by 90% and divide it by four. The result is your estimated quarterly tax payment.

With Form 1040ES, you make the same payment four times per year. If your income fluctuates throughout the year, you may not be able to afford to make equal payments. In these cases, you can make different payments each quarter.

Recommended Reading: What Is The Pink Tax

When Are The Quarterly Estimated Tax Payments Due

Quarterly tax payments are due April 15, June 15 and September 15 of the tax year, and January 15 of the next year. Your income tax liability accrues on income as it is earned, rather than being due on April 15 of the next year.

If you receive income unevenly during the year you may annualize your income. Complete the MI-2210 Annualized Income Worksheet to determine what quarter your payments are due.

You may make estimated tax payments using Michigan Department of Treasury’s e-Payments system or mail your estimated payment with a Michigan Estimated Tax voucher .

To ensure your estimated tax payment is received timely, allow 3 to 5 days for an electronic payment to be received and;2 weeks to post to your account.; Allow 2 weeks for a mailed payment to be received and 8 weeks to post to your account.

Note: Payments that are not received by the due date will be applied to the following estimated tax quarter.

Penalty is 25% for failing to file estimated payments or 10% of underpaid tax per quarter.;Interest is 1% above the prime rate.

What If Freelancing Is My Side Hustle

If you have a traditional job and freelancing is a âside hustleâ, you could likely be exempt from quarterly taxes by asking your employer to withhold more from your earnings. The same applies if your spouse has a traditional job and you file jointly.

Revising your withholding ensures that the amount you will end up owing will be less than $1,000 and you will not be penalized for underpayment.

To do this, you will need to fill out a new W-4 form. Navigate to the row called âOther Incomeâ and enter your expected net earnings from freelancer or contractor work. You can also use the IRS Tax Withholding Estimator tool to help you with this process.

Don’t Miss: How Much Do I Owe In Property Taxes

I See Clients In My Home Can I Take The Home Office Deduction

You can claim the deduction;as long as;the space you call your home office is;used exclusively;and regularly;for your business.;For example, if;you use a spare bathroom as a salon space and nothing else, that could qualify for the home office deduction. But if;you set up a temporary salon in your kitchen,;but;its also;where you;prepare meals and;eat with your family, that;space;would;not;qualify for the deduction.;Learn more;about the home office tax deduction.;

This article is up to date for tax year 2021 .

Recognize That Income Is Not Fully Spendable

Like employees who have taxes taken automatically from their paycheck, those paying estimated taxes must do their own withholding from revenue. For example, if youre a self-employed freelancer receiving a fee of $1,000, a portion must be viewed as withholding for estimated taxes.

How much should be withheld depends on your personal circumstances and tax rate. Consider setting aside at least 30% to account for your income tax, Social Security tax, and Medicare tax.

You May Like: How Do You Find Property Taxes By Address

Calculate How Much You Owe

You can calculate how much you owe based on your adjusted gross income . If you expect your income to be similar to your AGI from last year, this amount will serve as a basis for calculating how much you should pay this year.

You must adjust the amount by adding or subtracting money, depending on how much you expect to earn this year. After determining your adjusted gross income, and to obtain the total amount you owe, you must multiply your AGI by the corresponding income tax rate according to the 2019 tax bracket.

Finally, divide the taxes you owe between four to discover how much you should pay each quarter.;

For example, if you owe $3,000 in taxes, you have to pay $750 per quarter.

What Is Estimated Quarterly Business Tax

Quarterly business tax is a pay-as-you-go system for dividing your income and other federal taxes into quarterly installments.

As a small business or freelancer, youre responsible for managing your own taxes . Taxes can be complex, and there is a sliding scale for the amounts youll owe, so to make it easier the IRS has developed a pay-as-you-go estimated tax system. Businesses and individuals compute how much theyre likely to owe in income, employment, and other applicable taxes and then divide them into quarterly estimates which are met throughout the year.

Also Check: Where To File Taxes For Free

Why Do Some People Have To Pay Quarterly Taxes

Income received from just about any source is generally subject to income tax. That can include not only federal income tax, but also state income tax, and Social Security and Medicare tax.

The IRS requires that at least most of your tax liability is paid before the tax due date. While this is automatically accomplished through regular withholding, it must be done through quarterly estimated tax payments where withholding isnt available.

Why Are Quarterly Estimated Tax Payments Required

Our tax system is a âpay as you earnâ system, meaning that taxes must be paid as you receive income during the year. The government wants steady income throughout the year and quarterly payments are a way to ensure that they are getting it. Therefore, taxes must be paid either through withholding or estimated tax payments.

However, as a freelancer or independent contractor, you donât get income withheld from your payments. So when tax season rolls around, you do not get a tax refund. This often makes you liable to make quarterly payments on your taxable income. Before you stress eat that entire pint of ice cream, letâs talk through the mechanics of how to file quarterly taxes.

You May Like: Does Contributing To Roth Ira Reduce Taxes

How To Figure Estimated Tax

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use;Form 1040-ES, to figure estimated tax.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

When figuring your;estimated tax for the current year, it may be helpful to use your income, deductions, and credits for;the prior year;as a starting point. Use your;prior year’s;federal tax return as a guide. You can use the worksheet in Form 1040-ES to figure your estimated tax. You need to estimate;the amount of income you expect to;earn for the year.;If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated tax for the next quarter. You want to estimate your income as;accurately;as you can to avoid penalties.

You must make adjustments both for changes in your own situation and for recent changes in the tax law.

Corporations generally use Form 1120-W, to figure estimated tax.

Underpayment Of Estimated Income Tax

An addition to tax is imposed by law if at least 90% of your total tax liability is not paid throughout the year by timely withholding and/or installments of estimated tax except in certain situations. The addition to tax does not apply if each required installment is paid on time and meets one of the following exceptions:

- Is at least 90% of amount due based on annualized income

- Is at least 90% of amount due based on the actual taxable income;

- Is based on a tax computed by using your income for the preceding taxable year and the current year’s tax rates and exemptions;

- Is equal to or exceeds the prior year’s tax liability for each installment period and the prior year return was for a full year and reflected an income tax liability; or

- The sum of all installment underpayments for the taxable year is $150 or less

If you do not qualify for an exception, your underpayment computation will be based on 90% of the current year’s income tax liability or 100% of your liability for the preceding year, whichever is less. The addition to tax is computed on Form 760C .

Read Also: How To Calculate Payroll Taxes In California

What Happens If You Dont Pay Quarterly Estimated Taxes But Should

If you shouldve paid estimated taxes but didnt, you may be subject to a penalty. The IRS will usually calculate the penalty for you, but if youre curious, you can calculate it yourself with Form 2201 Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Tax law is complex and the laws surrounding quarterly estimated tax payments are no exception. You can read the IRSs Publication 505 Tax Withholding and Estimated Tax for additional insight, but its a good idea to talk with a tax professional to make sure you and your business are compliant with applicable laws in order to avoid unwanted penalties.

When Are Quarterly Business Taxes Due

Quarterly business taxes are due on April 15th, June 15th, September 15th, and January 15th .

In 2020, Tax Day was postponed from April 15th to July 15th to accommodate the unpredictable nature of the economic impact from COVID-19.;

In 2021, Tax Day for individual annual federal tax filings has been automatically extended to May 17.

Don’t Miss: When Does Income Tax Have To Be Filed

How To File Estimated Taxes With Keeper

Now that weâve gotten the why out of the way, letâs talk about the how.

First thing youâll want to do when you are filing estimate taxes is to use Keeper Tax’s quarterly taxes calculator to figure out how much you owe. This takes just a few minutes and requires only basic information like your rough monthly income and tax filing status.

ð¡ Pro tip: if youâre having trouble estimating your monthly self-employment income, donât worry. Itâs not critical to get it exactly right and the IRS gives you a 10% buffer in case youâre off. Also, itâs better to slightly overestimate than to under-estimate. At the end of the year, youâll get that money back as a refund. That is why you need to file quarterly taxes. Here’s what happens when you miss a payment.

Once youâve input your numbers, press submit and youâll get back exactly how much you should pay, along with links to making the payments online. As an added motivation, it also tells you exactly how much penalty youâll be avoiding by making the payment!

Now, all thatâs left is to make the payments online. For federal, click the âPay onlineâ button next to the corresponding amount, create an account and make a bank transfer. You can find step-by-step annotated instructions here.

If youâre lucky enough to live in an income-tax-free state, congratulations! Youâre done.

Keep Your Business And Personal Finances Separate

Worse, if you end up getting audited, you may have trouble providing proof of your claims if your business finances are mingled in with your personal. Keeping your business finances well organized can also reduce your risk of being audited in the first place, as your taxes are more likely to be accurately filed.

Whether youre running a corporation or youre a sole proprietor, its wise to open a business bank account. This account will limit your personal liability in addition to keeping your businesss finances in order. You can also open a business credit card for your business expenses; the right one might even earn you some lucrative rewards.

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Calculate How Much Youll Owe In Income And Self

Using our example, at the current tax rate, youd owe about;$4,000;in income taxes.4;And as we mentioned earlier, the self-employment tax is generally 15.3% of your;net;incomeso that means youll owe another;$4,950;for the year. Add your income tax and self-employment tax together, and youll get to your estimated taxes for the year. In this case, that total estimated tax bill for the year is $8,950.

Income Tax: $4,000Estimated Annual Taxes: $8,950

Getting Ahead Of Your Quarterly Tax Deadlines

Quarterly tax deadlines can creep up fast, leaving you feeling unprepared for a large payment to the IRS.

Bench offers a free consultation to learn how to organize your business financials and create a budget for each estimated tax payment. Book a call with our specialists and get prepared for the deadlines now.

Recommended Reading: Can Home Improvement Be Tax Deductible

How Do You File Quarterly Business Taxes

Quarterly estimated tax payments can be mailed using the printable vouchers in Form 1040-ES or use IRS Direct Pay to pay online. State and local taxes may not require quarterly filing, and may have their own procedures for payments, so work with a tax professional to be sure youre paying taxes correctly.

Divvy makes it easy to track all of your business expenses and payments in one seamless platform. Spend smarter by signing up now.

How Do I Know If I Have To File Estimated Quarterly Taxes

If youre self employed and expect to owe at least $1000 in taxes, then you must file quarterly.

Not sure if you count as self-employed?;According to the IRS, you count as self-employed if you:

- Carry on a trade or business as a;freelancer or independent contractor

- Are a member of a partnership that owns a;business

- Own your own business

This minimum extends to S-corporation shareholders, partnerships, and sole proprietorships. It doesnt matter if you have a full-time job and your self-employment income is generated from a part-time side gig. If you will owe more than $1000, make sure you make those quarterly payments.

LLCs and C-corporations must submit quarterly taxes if they expect to owe more than $500 in tax for the year.

Read Also: Why Does It Cost So Much To File Taxes