Filing For An Extension Online

To file for a tax extension separate from paying your taxes online, youâll need to fill out IRS Form 4868. The IRS offers a few tools to do this online. If your income is below $72,000 you can use Free File software, but if your income is above $72,000 youâll have to settle for the Free File fillable forms.

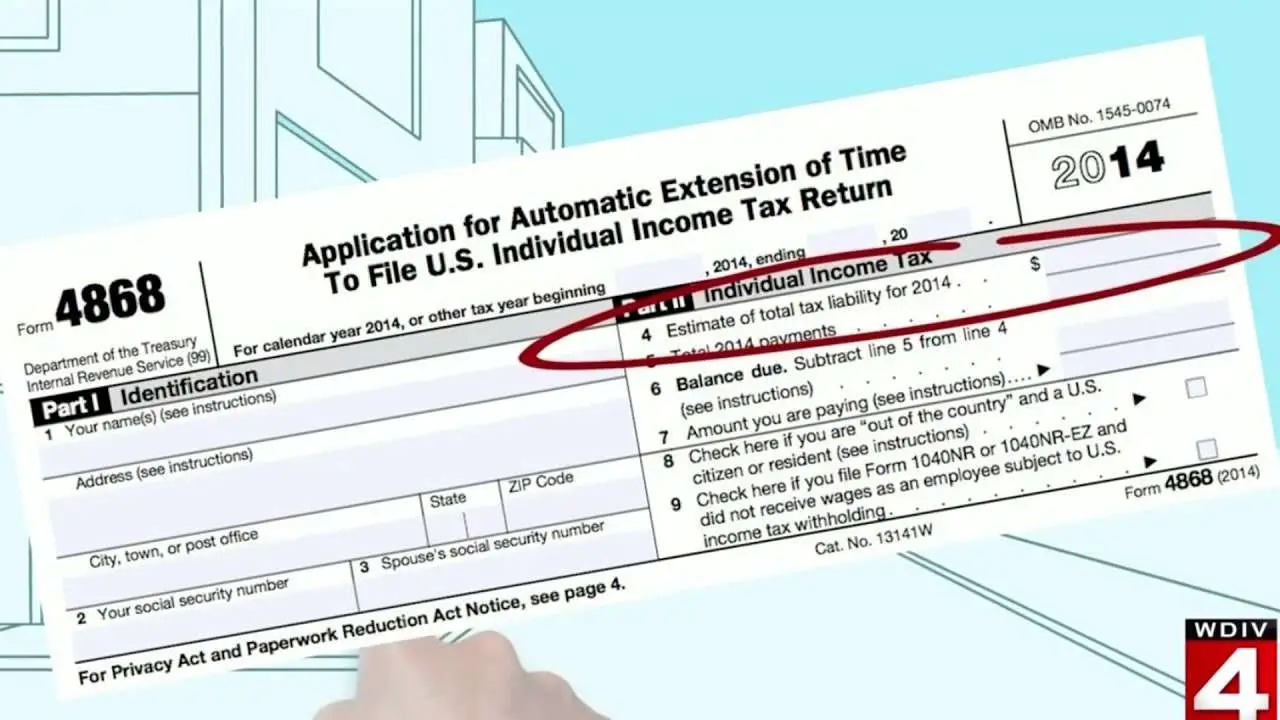

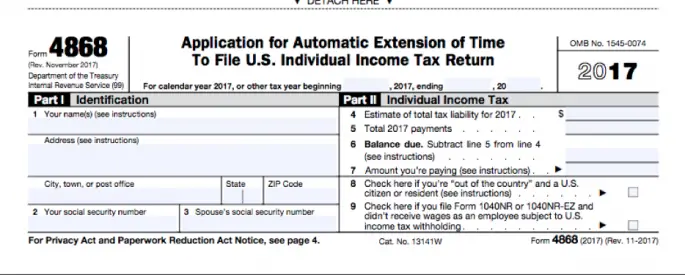

IRS Form 4868

Remember, youâll still need to pay your taxes by the April 15, 2021 deadline. So to file for an extension, youâll also need to estimate your total taxes owed and subtract the total amount of tax youâve already paid.

Form 4868 Part I: Identification

Part I has three lines and theyâre all for identification. Enter your name and address on Line 1. If youâre filing a joint return, donât forget to put both of your names. The name you put first should be whichever name you plan to put first on your actual tax return.

Line 2 is for your Social Security number and line 3 is for your spouseâs Social Security number if youâre filing jointly. Write your Social Security numbers in the same order that you wrote your names.

Learn more: Should spouses file jointly or separately?

The Best Tax Filing Programs

If you haven’t filed your 2020 taxes yet, consider using an online tax prep service to take advantage of expert tax assistance. This year is full of questions for most taxpayers, from the unemployment tax waiver to the child tax credit advance to how student loan deferment affects taxes. Choosing the right tax software can make a confusing process much more manageable.

Here are Select’s top picks for best tax filing software:

- Best overall tax software: TurboTax

You May Like: When Do We Start Filing Taxes 2021

Filing A Tax Extension

If you cannot complete your federal tax return by the tax filing date, you can typically file for an extension with the IRS by the tax filing deadline â if you live outside of the U.S., you may be able to get an extension by filing IRS Form 2350. Filing an extension will allow you to push your deadline to October 15, avoiding any potential late-filing or late payment penalties. However, any payments you owe are still due by the original tax due date, which is usually April 15, and You should submit your tax payment along with your extension request. Keep in mind an extension only pushes back the due date for the filing of your tax documents. It does not give you extra time to pay any taxes you may owe.

The Differences In Taxslayer & Turbotax

That means that the problem is more complex and requires the help of a specialist. Select the Always use the selected program to open this kind of file check box. In the Open With dialog box, click the program whith which open .tax2016 file you want the file to open, or click Browse to locate the program that you want. In this article you have learned how to open the .TAX2016 file with the Intuit TurboTax program on Windows and Intuit TurboTax program on Mac.

In cases when files were deleted and they cannot be restored by using standard operating system tools, use Hetman Partition Recovery. As a result, an important .TAX2016 file may be deleted. A message will appear This change will be applied to all files with .Intuit TurboTax Online extension. By clicking Continue you confirm your selection, click Contine to apply changes.

Changing the filename extension of a file is not a good idea. When you change a files extension, you change the way programs on your computer read/open the file.

PDF Converter is a online web-based document to PDF converter software. Convert and create PDF from various types of files like Word DOC, Excel XLS, PowerPoint PPT. Click the Choose Files button to select your DOC files.

Keyhole Markup Language File, a GPS data saved in the GPS Exchange format, an open standard that can be freely normal balance used by GPS programs. A file that stores map locations viewable in Google Earth, a global mapping program.

You May Like: Reverse Ein Lookup Irs

Is Your Payment Amount Incorrect

If you paid less than the amount owed, submit the difference between the amount paid and the amount owed. You can pay directly from your bank account through Online Services. Simply log in to your account, select Payments, bills and notices from the menu in the upper left-hand corner of your screen, select Make a Payment, then Make an extension payment.

If you overpaid and are owed a refund, you don’t need to do anything.

There Are Late Payment Penalties Even If You File An Extension

If you file your taxes on time but dont pay your taxes owed by the April 15 deadline, the IRS will charge you 0.5% on the taxes each month. Owed taxes also accrue interest, compounded daily, at 5%. These payments get hefty fast. Even if you file late after getting an extension, Id still pay an estimate on time.

Also Check: Plasma Donation Taxable

Software To Open Or Convert Tax2016 Files

Either option is straightforward and easy to accomplish through clear instructions and links from the IRS. When you retrieve old tax returns through Turbotax, save a copy in an easily accessible place. Print a paper copy to store in your filing system and save old returns on your computer for easy access and sharing. Having dedicated tax files saved for each year ultimately saves time and headaches when they are needed. The TurboTax guarantee applies to everyone, which includes individuals, home business owners, and multi-member LLC businesses. TurboTax also offers free live online advice with tax experts. This one-on-one service enables users to ask tax professionals questions that are tailored to their specific situation.

We strive for 100% accuracy and only publish information about file formats that we have tested and validated. To find a file you need, use the programs interface to open the folder it was deleted from, or go to the folder «Content-Aware Analysis» and select the required file type.

Heres How Turbotax Just Tricked You Into Paying To File

In each folder that it encrypts a file, it will also create aDECRYPT_YOUR_FILES.HTMLransom note. It is possible to close this screen by using the Ctrl+F4keyboard combination.

Other types of files may also use the .tax2016 file extension. You will most likely only see a TAX2016 file if you are using the desktop version of TurboTax, which is available for both Windows and Mac. However, the TAX2016 file may also be exported from TurboTax Online. To export a TAX2016 file from TurboTax Online, click Tools, then select Save your 2016 return to your computer. You can then open the return in the desktop version of TurboTax.

Recommended Reading: How Can I Make Payments For My Taxes

Setting Up An Installment Plan

If you have difficulty paying the full amount of tax you owe, you can ask the IRS to work with you and set up a payment plan, and the IRS may allow you to pay in installments. The IRS must approve this payment method, and you can apply for a personal online payment agreement. The installment agreement is set up through direct debit using a direct debit plan to ensure that you donât have to write and mail a check each month.

Not Ready To Pay Electronically

Use Form IT-370-V, Payment Voucher, or Form IT-370-PF, Payment Voucher for Partnerships and Fiduciaries, to mail in a check or money order.

Note: You must apply for an extension of time to file your return when you mail in your payment voucher simply mailing in a payment voucher to pay the tax due is not sufficient.

You must:

- Write your Social Security number and 2020 Income Tax on your check or money order.

- Make your check or money order payable to New York State Income Tax.

- Mail your payment to:

Recommended Reading: How To Find Your Employer’s Ein

Paying Your Irs Taxes By Mail With Check Or Money Order

You can always choose to mail your tax payment using your check or money order. The check or money order must be made payable to the United States Treasury. Your check must show the following information: your name and address, daytime phone number, Social Security number or employer identification number, tax year, and related tax form or notice number. For the information not printed in the check/money order, you should use the memo field on the paper check. The payment must be sent along with Form 1040-V but donât staple or paperclip them together.You need to mail it to the appropriate address shown on Form 1040-V, or you can find the correct address for the nature of your payment and your state of residence on the IRS website.

Filing An Individual Extension

Read Also: Tax Lien Investing California

How To Fill Out Irs Form 4868

Form 4868 is a simple, two-part form that takes up less than half a sheet of paper. The first part is just for personal identification and the second part asks you to estimate your tax liability because if you owe a tax bill, you still need to pay it by Tax Day. You can read more of the Form 4868 instructions below.

What You Should Know Before You File An Extension

State and Federal taxes are due on April 15, every year. Turning your taxes in late can result in fines and late fees. The IRS considers your taxes late if you dont file and pay taxes owed by tax day.

If something comes up and you cant meet the deadline, file an extension. The last thing you want is to rack up late fees and interest. However, it can take a little time to process the request, so youll want to file as soon as you know youll be late to ensure that your request is filed before the tax deadline.

Remember that this information is for federal tax extensions only. Each state has its own requirements for filing an extension. So youll need to figure out the requirements for that process too.

Before you file a tax extension, there are a few other things you should be aware of.

Read Also: How To Buy Tax Lien Properties In California

Youll Get Six Extra Months To File Your Taxes But No Extra Time To Pay Your Bill

If you need more time to file your taxes either because you had a family emergency, couldnt get your papers together in time or were just too busy you have options when it comes to filing a tax extension. But contrary to popular belief, a tax extension doesnt give you extra time to pay your taxes. It just gives you extra time to file. Heres a step-by-step guide on how to do it.

Tax filing and payment deadline

The IRS has extended its 2020 tax filing deadline until May 17, 2021. You have until that date to file and pay any federal taxes you owe.

How Evolution Tax And Legal Can Help With Your Tax Payments

When deciding which payment method will work best for you or if requesting an installment plan or an extension is the way to go, remember to carefully consider your tax payment options interest rates and other costs. An installment agreement/payment will not stop interest and penalties. The tax planning attorneys at Evolution Tax and Legal team is here to help you navigate the complex tax world and help you avoid penalties and unnecessary interests, helping you to save money.

Recommended Reading: How To Buy Tax Lien Properties In California

Do I Have To Pay My Taxes By The Last Day Of Tax Season If I File An Extension

Yes. Filing a tax extension keeps you in good standing with the IRS on the forms side, but a tax extension doesnt grant you more time to pay what taxes you owe beyond the tax due date. However, dont let your inability to pay prevent you from filing on time avoiding filing your return because you cant make a tax payment will only make matters worse. Requesting an IRS Installment Agreement is generally a much better choice.

Pdf Converter Convert Files To And From Pdfs Free Online

Was your 2016 return prepared with Online TurboTax? If so, log in to your account and look in the section Your Tax Returns & Documents.Choose tax year 2016, and look for a link to download/print the PDF. Do you find evidence of your return there OK, but when you try to download, does it ask you to pay? If it was prepared in Free Edition last year, access will be locked. If thats your situation, we can tell you how to pay to unlock your 2016 return. The method to unlock it depends on what all you have done with your 2018 return.

Saving tax returns each year is prudent as they are often needed for home loans and other lending matters. The ability to prove your income through tax returns is handy, and it saves time to make them accessible. Our free tax2016 viewer online tools does not required any registrations and installations on your system, 100% free and online turbotax 2016 tax return viewer tool. Open from any device with a modern browser like Chrome, Opera and Firefox. You will need a program compatible with the specific file you are trying to open, as different programs may use files with file extension TAX2016 for different purposes. The TAX2016 file extension indicates to your device which app can open the file. However, different programs may use the TAX2016 file type for different types of data.

You May Like: Cook County Appeal Property Tax

More Time To File Not More Time To Pay

Its important to remember that the Form 4868 extension gives you more time to file, not more time to pay. You will still have to pay your taxes by that year’s original due date of the return , even if the IRS grants an extension to file later than that.

If you think you may owe taxes when it comes time to file your return, you should estimate how much you will owe and subtract any taxes that you have already paid .

If your estimate is on the high side and you end up overpaying, you will get a refund when you eventually file your return. That will also avoid penalties and interest accumulating if you underestimate your taxes due.

You can pay part or all of your estimated income tax online using a debit or credit card or through an electronic funds transfer using Direct Pay.

Even if you file electronically, you can mail a check or money order to make your tax payment. Make the check or money order payable to United States Treasury and include a completed Form 4868 to use as a voucher.

You do not need to file a paper Form 4868 if you submitted one electronically and are not mailing a payment.

An extension on your federal tax return does not apply to your state tax return you must apply to your state separately for that, and the rules vary among the states.

How Do I File An Irs Extension In Turbotax Online

IRS extensions for tax year 2020 must be filed on or before May 17, 2021 for domestic taxpayers.

It isn’t possible to file a post-deadline extension.

Keep in mind: An extension doesn’t give you extra time to pay your taxes but it will keep you from getting a late filing penalty. .

Note: If you’re paying additional taxes owed with direct debit, you’ll need to provide your 2019 AGI for verification purposes .

If you don’t have your AGI, or your extension gets rejected for the wrong AGI, here are 2 options:

If you filed prior to the deadline, but were rejected, you will likely have until May 24 to mail in your extension.

Related Information:

Read Also: Where Is My State Tax Refund Ga