How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long.;But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

How To Verify With The Irs That A Tax Return Was Received

Once youve put in the time and effort required to file your tax return, you want to make sure your work isnt lost in cyberspace or in the mail. If youre due a refund, you want your forms to arrive safely and be processed as quickly as possible. The Internal Revenue Service offers several ways for you to verify that your return has been received and that your IRS refund status is being processed.

What To Do If You Havent Received Your Refund

Again, theres really no way to speed along the processing of your return and the payment of your refund if theres no specific issue with your return or evidence of fraud. If the IRS needs more information to finalize your refund, provide this in a timely manner.;

If you submitted the wrong bank account information for direct deposit, you can contact your bank and try to sort it out. If this doesnt go anywhere, you can file Form 3911 for IRS assistance. However, the IRS cannot force your bank to transfer or return the money.;

If you suspect that your paper check was lost or stolen, you can start an IRS trace.;

In the event of tax return preparer fraud, the process to remedy your situation is lengthy. Youll need to file a police report and provide a handful of documents to the IRS.;

Finally, if you are experiencing financial hardship while waiting for your return to be processed, you may be able to request that the IRS expedite your refund.;

Recommended Reading: Do I Pay Taxes On Stimulus Check

What Does A ‘math Error’ Notice From The Irs Mean

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.;

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”;

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

When Are Taxes Due

For most years, the deadline to submit your tax return and pay your tax bill is April 15. But for your 2020 taxes, it was pushed back about a month to May 17, 2021 due to the Coronavirus pandemic. Theres currently no such plan in place for the 2021 tax year, for which youll file in early 2022.

If you still cant meet the tax filing deadline;for the upcoming year, you can file for an extension. But the sooner you file, the sooner you can receive your tax refund.

Recommended Reading: How To Track Your Taxes

Was Your Refund Supposed To Go Directly To Your Bank Account

There are a few things that could have happened:

- The bank account information you put on your tax return was incorrect.

- The IRS isnt responsible if you made an error on your tax return. Youll need to contact your bank or credit union to find out what to do.

- If you already contacted your bank or credit union and didnt get any results, file Form 3911, Taxpayer Statement Regarding Refund with the IRS. The IRS will contact the institution and try to help, but the IRS cant require the bank or credit union return the funds.

Your Return Hasnt Been Processed

The IRS has been behind on processing returns for the entire tax season, but there are a few situations causing additional delays for some taxpayers:;

- You mailed your return instead of filing electronically.;

- Your return has errors like an incorrect Recovery Rebate Credit.

- Your return is incomplete.;

- You filed a claim for the Earned Income Tax Credit or Additional Child Tax Credit .;

- You submitted Form 8379, Injured Spouse Allocation.;

- You are a victim of identity theft or fraud.;

- Your return needs additional IRS review.;

If the IRS contacts you requesting clarification or more information, responding in a timely manner may help move your return along.;

Recommended Reading: Where To File Georgia State Taxes

How Should You Contact The Irs For Help

The IRS received;167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only 7 percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agency’s;live phone assistance;is extremely limited right now because the IRS says it’s working hard to get through the backlog. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the;Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can;contact your local IRS office;or call to make an appointment: 844-545-5640. You can also contact the;Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.;

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the;Where’s My Refund;tool tells you to contact the IRS. You can call: 800-829-1040 or 800-829-8374 during regular business hours.;

Cmo Funciona El Programa De Compensacin Del Tesoro

El Programa de Compensación del Tesoro funciona de la siguiente manera:

La Oficina del Servicio Fiscal del departamento del Tesoro verificará si su nombre e información de contribuyente está en su base de datos de deudores morosos.

Si hay una coincidencia, la BFS le notificará que está deduciendo la cantidad que debe de su reembolso de impuestos.

La BFS enviará el monto que adeuda a la agencia de Gobierno a la que le debe el dinero.

Si su deuda es mayor que el monto del reembolso que iba a recibir, entonces la BFS le enviará el total del reembolso a la otra agencia gubernamental. Si debe menos, la BFS le pagará a la agencia la cantidad que debe y luego le enviará a usted el saldo restante.

Aquí hay un ejemplo: usted estaba por recibir un reembolso federal de $1,500 pero debe $1,000 por un préstamo estudiantil. La BFS deducirá $1,000 de su reembolso de impuestos y lo enviará a la agencia del Gobierno que corresponda. Luego le enviará a usted una notificación con una explicación del porqué se retuvo esa suma, junto con los $500 restantes de su reembolso de sus impuestos.

El Servicio de Impuestos Internos cuenta con información para ayudarle a entender qué es una compensación de reembolsos de impuestos .

Don’t Miss: How To Calculate Net Income After Taxes

I Just Filed My Return How Do I Check My Tax Refund Status

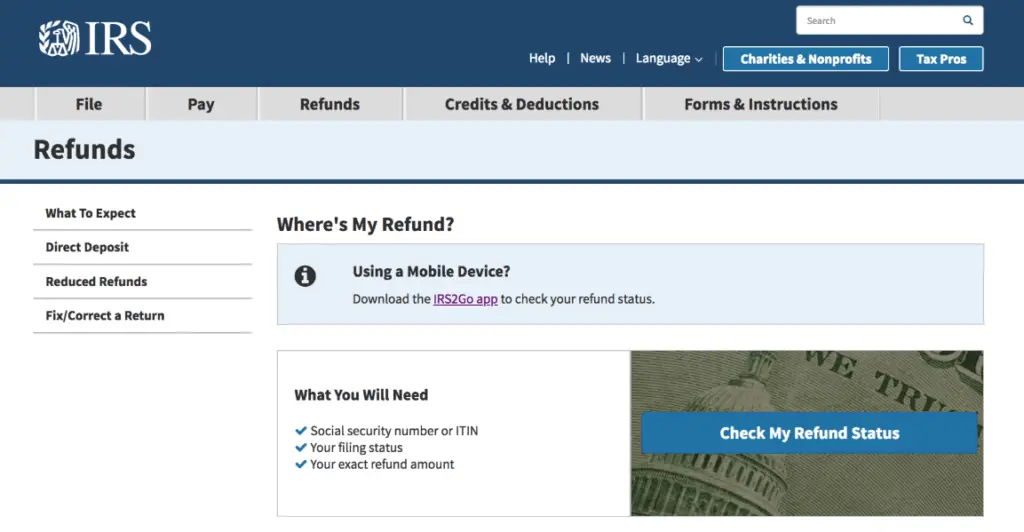

You can check your tax refund status online using the IRSâs handy Whereâs My Refund? tool.

Youâll need three pieces of information to login to the tool:

Your Social Security number or Taxpayer Identification Number

Your filing statusâ”Single,â “Married Filing Joint Return,â âMarried Filing Separate Return,â âHead of Household,â or âQualifying Widowâ

Your exact refund amount

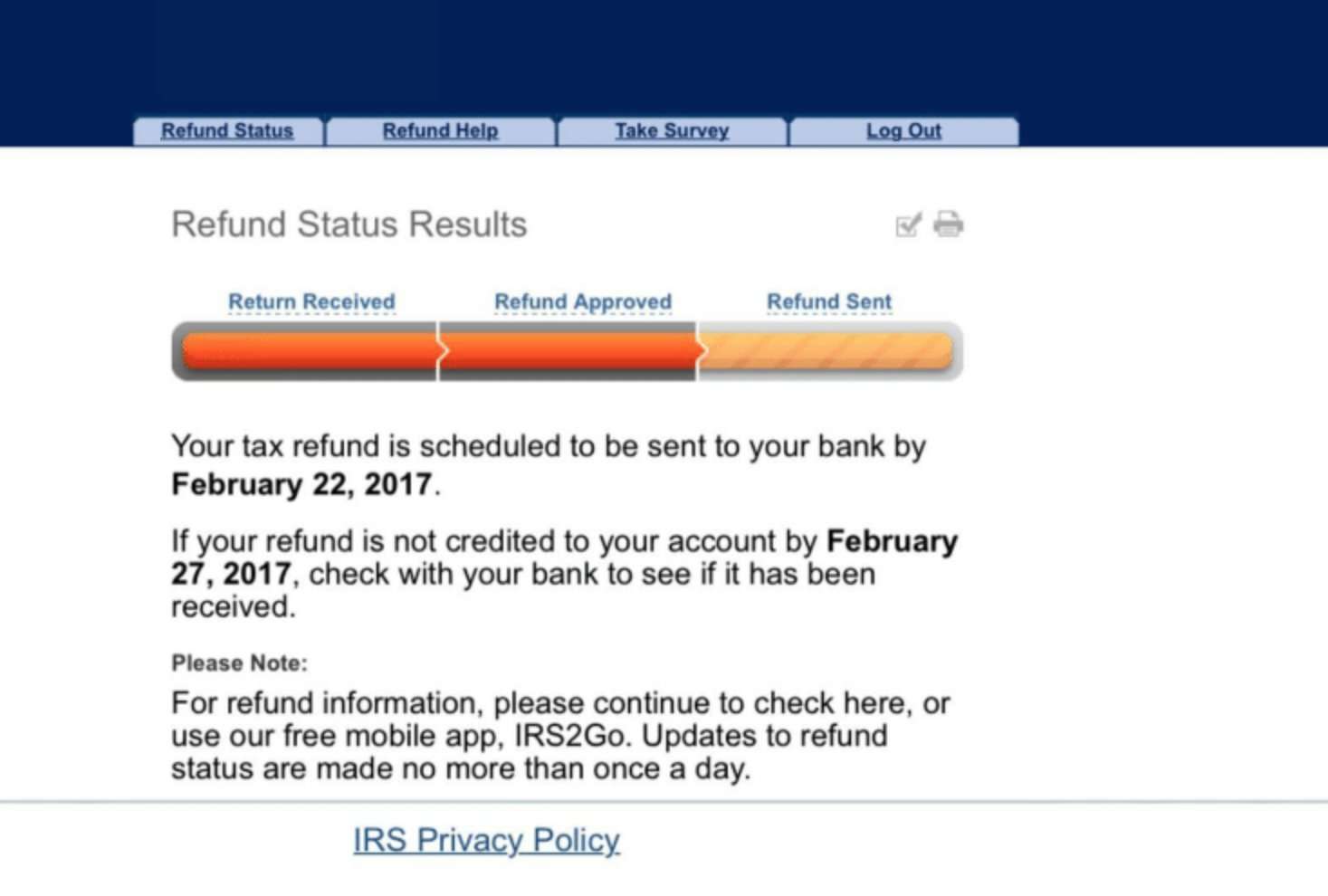

Hereâs what the login page for the Whereâs My Refund? tool looks like before you login:

How To Check Your Return And Refund Status

The only way to track your return and refund is to use the Wheres My Refund? tool on IRS.gov. You can call the IRS Tax Help Line at 800-829-1040, but if your return is active on Wheres My Refund? you are unlikely to get any additional details not provided online.;

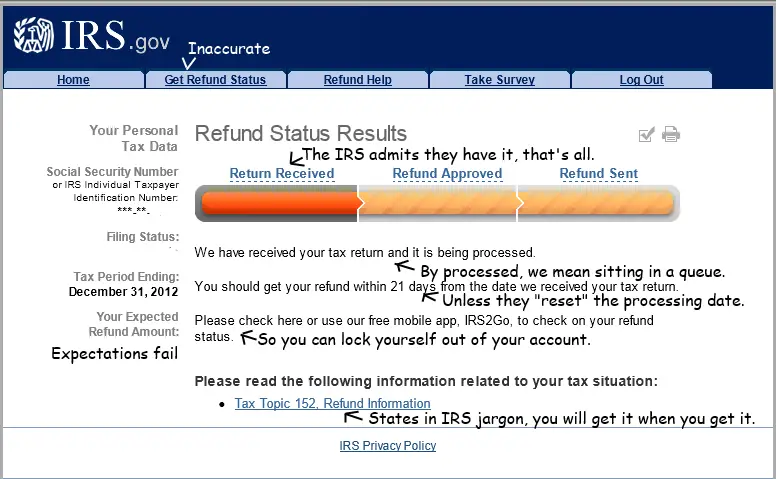

Your return status should appear within 24 hours of filing your electronic return or within four weeks of mailing your paper return. A status of received indicates that the IRS has your return for processing, and a status of approved means that the IRS has approved your refund. You will also see when the funds are expected to be distributed, and the status will change to sent when your refund is on its way.;

Recommended Reading: How Much Is Tax In Georgia

No Sign Of Child Tax Credit Payments Yet

The new child tax credit payments are going out monthly to;eligible parents through December — you can;calculate your payment here. If you don’t have direct deposit set up with the IRS, your payments will likely arrive as paper checks. And if you’re still waiting for a child tax credit check and you qualify for the money, a wrong address could be the problem. You can track your payment or file a payment trace to see if it went to the wrong address.;

However, if you’ve moved recently and you haven’t updated your information with the IRS or USPS, it’s likely your money could wind up at your old address, potentially causing a delay as you wait for your check to be rerouted. You can now update your mailing address using the Child Tax Credit Update Portal to make sure your payments are being sent to the right place. ;

Should You Call The Irs

Expect delays if you mailed a paper return, had to respond to an IRS inquiry about your e-filed return, claimed an incorrect Recovery Rebate Credit amount or used 2019 income to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return.

Paycheck Checkup: you can use the IRS Tax Withholding Estimator;to help make sure your withholding is right for 2021.

Recommended Reading: How Do I Get My Property Tax Statement

When Will My Return Information Be Available

Please Note: The IRS began accepting and processing 2020 tax year returns on Friday, February 12, 2021. Since e-filed state returns are first sent to the IRS, we ask that you consider and recognize this adjustment to the processing timeline for the 2020 tax year returns. Your patience is greatly appreciated.

- Up to 5 business days after filing electronically

- Up to 3 – 4 weeks after mailing your paper return

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.;

If you adjusted your withholding part way through 2020, the IRS recommends that you check your withholding amounts again. Do so in early 2021, before filing your federal tax return, to ensure the right amount is being withheld.

You May Like: Do Nonprofits Pay Payroll Taxes

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, if they chose direct deposit and there are no other issues with their tax return. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 22. So EITC/ACTC filers will not see an update to their refund status for several days after Feb. 15.;

Cmo Revisar El Estado De Su Reembolso De Impuestos Federales

Use la herramienta ¿Dónde está mi reembolso? o la aplicación móvil IRS2Go para verificar su reembolso en Internet. Estos sistemas se actualizan una vez cada 24 horas y son las formas más rápidas y fáciles de rastrear su reembolso.

Puede llamar al IRS para verificar el estado de su reembolso. Sin embargo, la asistencia telefónica en vivo del IRS es extremadamente limitada en este momento. Los tiempos de espera para hablar con un representante pueden ser largos. Pero puede evitar la espera utilizando el sistema telefónico automatizado. Siga las instricciones del mensaje cuando llame.

Read Also: How To Know If You Filed Taxes Last Year

Log In Or Create An Account

Once you’ve logged in to your Online Services account:

Filing Information sample form: Field 5: State/ProvinceField 6: Zip/Postal CodeField 7: Filing Method Option 1: Gross Weight Method Option 2: Unloaded Weight MethodField 8: Number of Vehicle Records to Report

Header cel: Electronic notification optionsBills and Related Notices-Get emails about your bills.Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.Header cell: Receive email

My Bank Account Number Has Changed I Want To Change The Bank Account Number Which I Mentioned In My Income Tax Return

You can only change your Bank Account Number if you had a refund failure i.e your IT Return is processed and a refund was generated for you but you did not receive it. If you wish to change the Bank Account Number for Refund failure case, then login in the Income Tax e-Filing website and go to My Account â Refund re-issue request. Select the mode through which you wish to receive the refund- ECS or Cheque. Enter the new Bank Account Number and provide address details. Submit the request.

Once the request is submitted, your new Address is updated with the Income Tax Department.

Recommended Reading: What If I File Taxes Late

How Do I Confirm That The Irs Received My Paper Mailed Tax Return

The IRS asks you to wait 4 weeks after you mail your return before looking up your refund at Where’s My Refund?

The “Where’s My Refund” tool,located;at;,;follows your tax return fromreceipt to completion. It will tell you when your return is in received statusand if your refund is in approved or sent status.

The IRS releases most refunds within 21calendar days after the e-filed return has been accepted. For mailed returns, allow56 weeks from the postmark date.

For more information please click the link below.

Opt To Check Your Refund Status

Once you’ve arrived on the IRS refunds page, you can opt to check your status. If you’re on a mobile device, you can download the IRS2Go app to keep tabs on your refund status and other important tax information. If you just want to use your browser, either one your computer or your mobile device, simply click Check My Refund Status. don’t forget to read over the list of information you’ll need, including your Social Security or ITIN number, your filing status and your exact refund amount.

Also Check: Can You Change Your Taxes After Filing

How To Check Check The Status Of Your Tax Refund

Online

Visit Refund Status on MassTaxConnect.

You will be asked;to:

- Choose the ID type,

- Choose the tax year of your refund, and

- Enter your requested refund amount.

To check the status of your tax refund by phone, call 887-6367 or toll-free in Massachusetts 392-6089 and follow the automated prompts.

What Do Do If You Still Haven’t Received Your Tax Refund

In a normal year, most Americans expect to receive their tax refunds quickly, usually within a few weeks of filing their returns. But with processing delays due to COVID-19, many are waiting much longer.;

The IRS is saying that most refunds are still issued within 21 calendar days. So what happens if you still haven’t received your tax refund? Heres why yours may not have arrived and what you can do about it.;

Read Also: How To Subtract Taxes From Paycheck